- #Budget monthly expenses spreadsheet update

- #Budget monthly expenses spreadsheet software

- #Budget monthly expenses spreadsheet download

#Budget monthly expenses spreadsheet update

Adjust your budget over time: Continually update your budget over time to see how your estimates compare with actual sales and expenses.Include the total cost of goods sold (the total amount it costs to produce your product or service), and factor in other costs like shipping, equipment, and materials for your office or production facility. Calculate your profit margin: To determine how much profit you expect the business to make, subtract your expenses from estimated sales and revenues.Also determine estimates for your variable costs, including materials and equipment, labor, salaries for company executives, employee benefits, and training and travel expenditures. Determine fixed and variable costs: Calculate all the fixed costs involved in operating your business such as rent, insurance, and business licenses.Set profit goals, and make realistic revenue projections for the year and into the future. Estimate sales and set profit goals: Calculate the sales you expect to make during different times of the year, factoring in holidays, office or plant closures, and seasonal booms and lulls.

If you’re starting a new business, look for financial information on a business similar to yours (in size and type) and use it as a benchmark.

#Budget monthly expenses spreadsheet software

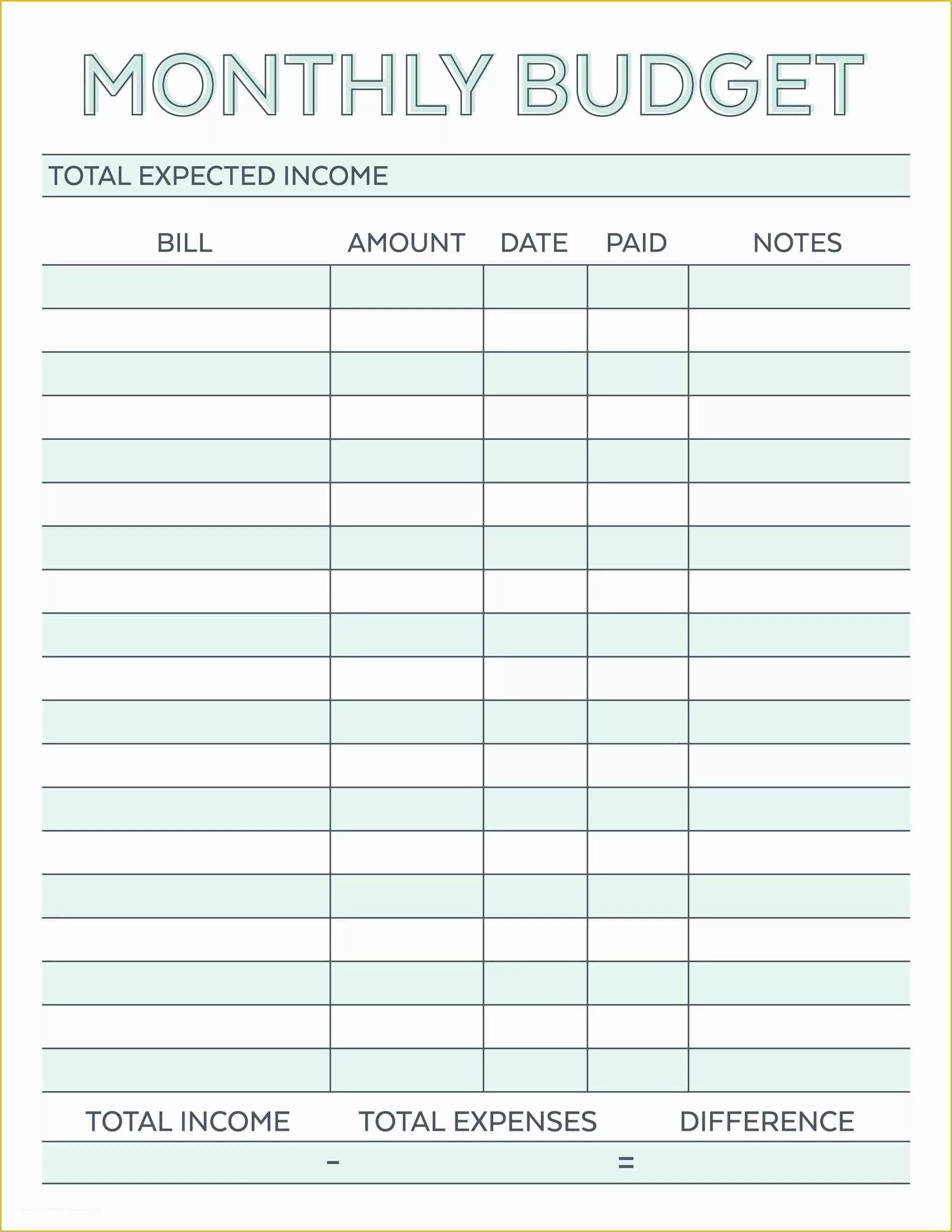

You may also choose to purchase business budget software to create a more detailed plan. When creating your initial budget, you can use a business budget template to help calculate revenues, expenses, and profits.

#Budget monthly expenses spreadsheet download

Download the template that best fits your needs, and start planning for financial success. To help you get started, we’ve created a variety of business budget templates for Excel that you can use for any organization - from startup companies to established enterprises. Project startup costs, monthly operational expenses, and revenue needed to break even.Keep colleagues and coworkers informed on the financial health of the business.Secure funding from current and potential investors or financial institutions.Gauge the positive impact of budget changes.Plan for required purchases, such as equipment and materials.Properly allocate revenue to other areas of the business.Using business budgeting worksheets for this purpose can help you: Of course, you’ll also need to document and track your budget. By making and following a budget, you can better control costs, avoid overspending, and plan to meet financial goals. Failure to properly budget can seriously impact your bottom line, and even jeopardize the success of your enterprise. Getting started with the Smartsheet APIĬreating a budget is always a good idea, but it’s even more crucial when you run a business.ENGAGE 2023 Smartsheet ENGAGE brings together our global customers, experts, and partners to share their experiences, ideas, and best practices.Smartsheet events Your hub for Smartsheet events, webinars, Q&As, and user groups.Partners Learn about the Smartsheet partner program and access our partner directory.

Community Explore user-generated content and stay updated on our latest product features.Help and Learning A comprehensive knowledge base, including articles, tutorials, videos, and other resources that cover a range of topics related to using Smartsheet.Content Center Articles and guides about project management, collaboration, automation, and other topics to help you make the most of the Smartsheet platform.

0 kommentar(er)

0 kommentar(er)